Now that you know your AR turnover ratio, what can you do to improve it? Improving Your Accounts Receivable Turnover RatioĪ low AR turnover ratio can indicate poor collections policies and/or a larger than ideal percentage of financially irresponsible customers. As an example, had you found your ratio was double what it is, or 10.9, you would know that you’re collecting invoices in half the time, or in 34 days.

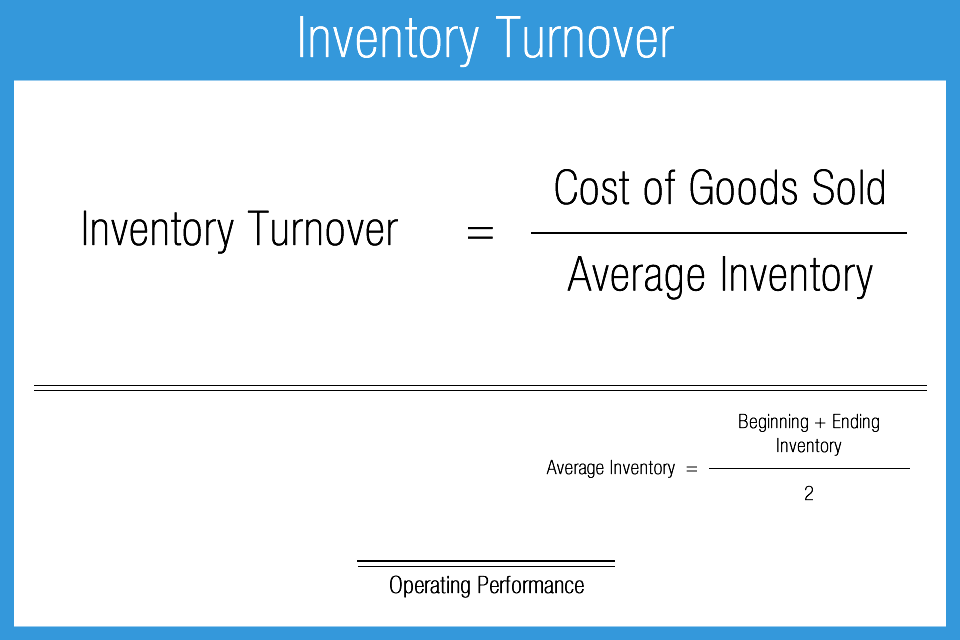

To collect invoices faster, you need a higher ratio. This tells you that it took an average of about 67 days for you to collect on an invoice. To put that in terms that are easier to understand, divide the total number of days in the year by your ratio. This means that your AR turned over 5.45 times in the last year. Your accounts receivable turnover ratio is 5.45. To compute your AR turnover ratio we’ll use formula detailed at the top of this section. And we now know your average AR was $27,500. Let’s say that you had $150,000 in net credit sales for the year. Computing Your Accounts Receivable Turnover Ratio This shows that your average AR is $27,500 for the year. Let’s say you had $20,000 in AR at the start of the year and $35,000 at the end. You’ll compute this by adding your accounts receivable amount from the beginning of the year to the amount from the end of the year. This represents the average amount of money owed to your business as invoices at any given time. To compute your net credit sales you’ll take your total annual sales and subtract any cash sales, sales returns, and other allowances, such as price changes and discounts. This is the portion of your annual sales that are tied up in invoices. Here’s a bit more information on these two measures. To compute this ratio you’ll divide your net credit sales by your average AR.

These numbers are available on your company’s balance sheet. To compute this ratio you’ll need to know your company’s net credit sales and your average accounts receivable.

#AR TURNOVER RATIO AMAZON HOW TO#

How To Compute Your Business’s Accounts Receivable Turnover Ratio It isn’t difficult to compute and knowing your company’s ratio will give you a benchmark against which you can judge attempts to collect invoices more rapidly. The AR turnover ratio is a standard metric used to determine the pace with which businesses are able to collect their debts. It’s better for cash flow purposes and saves money and headaches associated with trying to collect delinquent debts. The quicker your business is able to collect on outstanding invoices, the healthier it will be financially.

0 kommentar(er)

0 kommentar(er)